irrevocable trust capital gains tax rate 2020

Irrevocable trusts are very different from revocable trusts in the way they are taxed. A trusts income must reach this threshold before it is taxed at 396 on ordinary income and at 20 on capital gains.

5 Ways To Modify An Irrevocable Trust Wealth Management

An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a.

. What is the capital gains tax rate for trusts in 2020. Consequently if the trust. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. In 2020 to 2021 a trust has capital gains of 12000 and. The highest trust and estate tax rate is 37.

What is the capital gains tax rate for trusts in 2020. Irrevocable trust capital gains tax rate 2020. What is the capital gains tax rate for trusts in 2020.

You can find your adjusted gross income on line 11. What is the capital gains tax rate for trusts in 2020. For tax year 2020 the 20 rate applies to amounts above.

Married couples filing jointly enjoy the 0 capital gains rate when their taxable. For tax year 2020 the 20 rate applies to amounts above. An individual would have to make over 518500 in taxable income to be taxed at 37.

The maximum tax rate for long-term capital gains and qualified dividends is 20. The maximum tax rate for long-term capital gains and qualified dividends is 20. The maximum tax rate for long-term capital gains and qualified dividends is 20.

For tax year 2020 the 20 rate applies to. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021.

They would apply to the tax return filed in. 2022 Long-Term Capital Gains Trust Tax Rates. Report the applicable amounts calculated on this form on line 13200 or line 15300 of Schedule 3 Capital.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. The trustee of an irrevocable trust has. Capital gains and qualified dividends.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Capital gains however are not considered to be income to irrevocable trusts. Sunday June 12 2022.

What is the capital gains tax rate for trusts in 2020. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Instead capital gains are viewed as contributions to the principal.

It continues to be important to obtain. Qualified dividends are taxed as capital gain rather than as ordinary income. The remaining amount is taxed at the current rate of capital gains tax for trustees in the 2020 to 2021 tax year.

For tax year 2020 the 20 rate applies to. Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual. If the trust has capital losses in excess of capital gains for any tax year.

How can I find the capital gains tax rate for trusts. The tax rates for trusts are extremely compressed.

Installment Sale To An Idgt To Reduce Estate Taxes

Creative Estate Tax Strategies To Consider For 2021 Denha Associates Pllc

10 Rules Of Thumb For Trust Income Taxation Gwa Blog

Estate And Asset Protection Planning In New York An Overview Of Trusts Lorman Education Services

The Differences Between A Revocable And Irrevocable Trust

Difference Between A Revocable And An Irrevocable Trust In Florida Epgd Business Law

Navigating Family Trusts And Taxes Turbotax Tax Tips Videos

Biden Tax Plan And 2020 Year End Planning Opportunities

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Analyzing Biden S New American Families Plan Tax Proposal

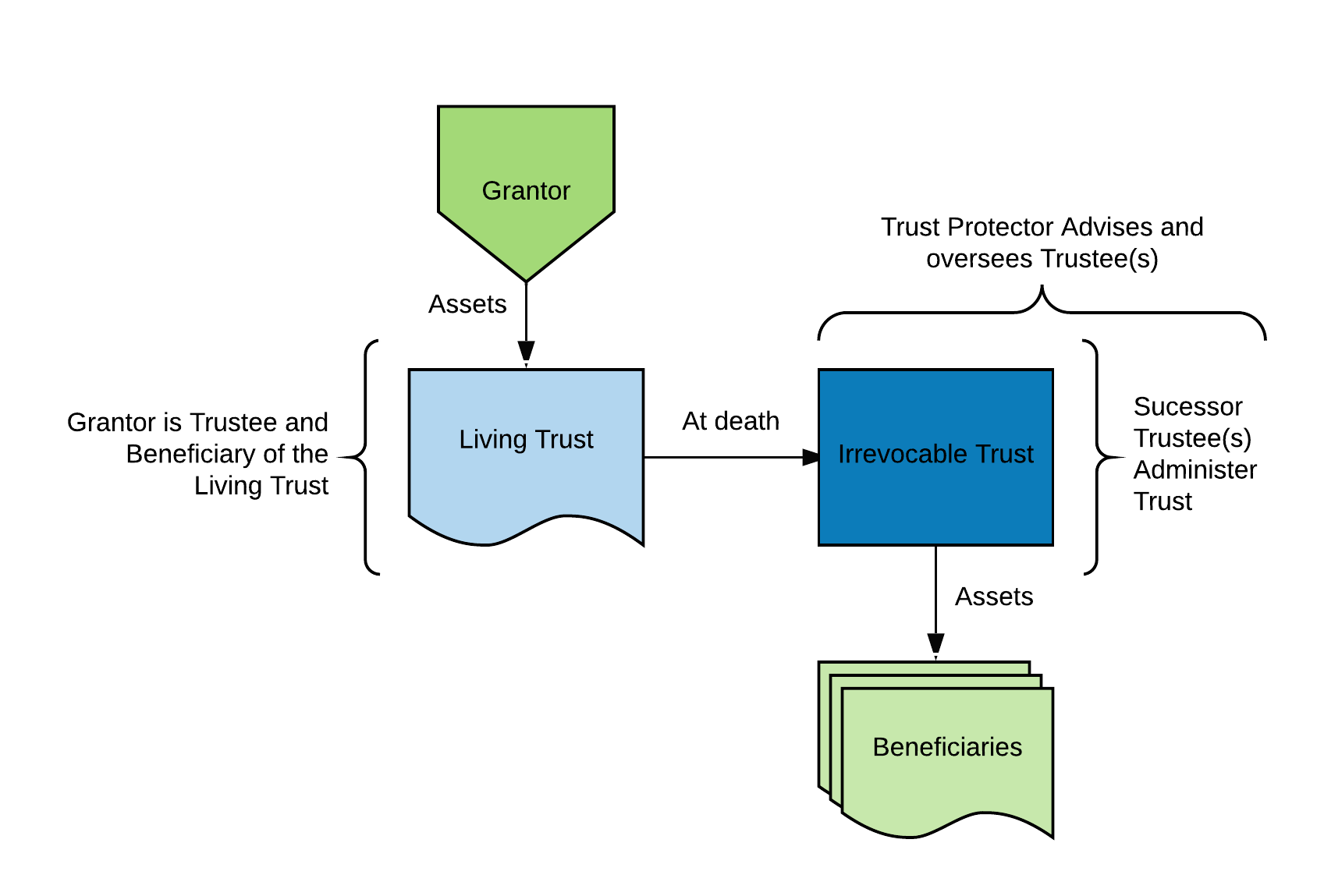

Irrevocable Trust Callahan Financial Planning

Dividing A Trust Into Subtrusts In Nevada

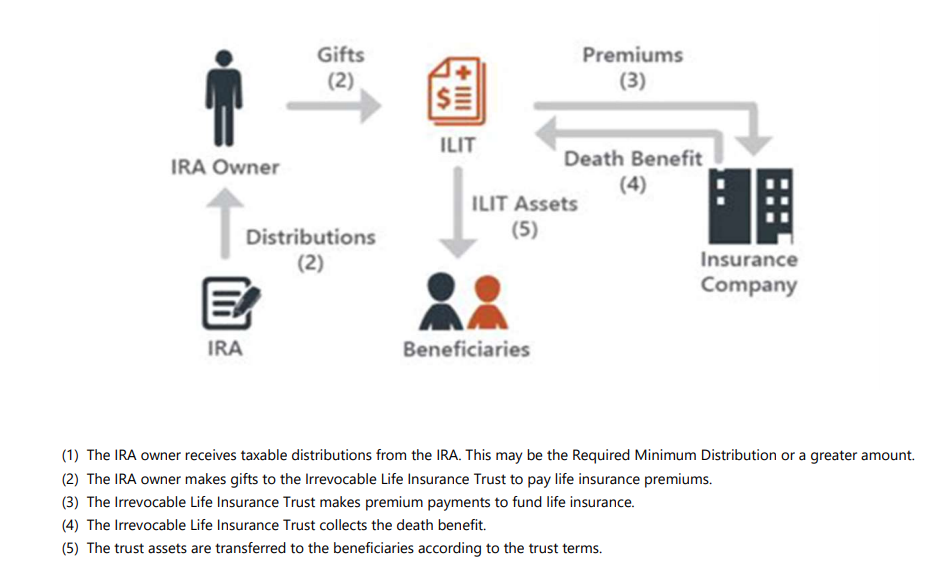

Definitive Guide On Irrevocable Life Insurance Trusts

Estate Planning 101 Series Lesson 1 Charitable Remainder Trusts Eckert Byrne Llc

Election Special Bulletin 1 Tax Plan Proposal

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Estate Planning San Francisco Bay Area Trust Probate And Conservatorship Litigation Lawyer Blog Talbot Law Group P C

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool